Imagine this: In the vast digital gold rush of 2025, where fortunes flip faster than a coin in a Bitcoin block, savvy investors in Australia are eyeing mining machines as the ultimate edge. According to the latest report from the Australian Securities Exchange (ASX 2025 Digital Assets Outlook), the crypto mining sector surged by 45% in value last quarter alone, driven by renewable energy integrations and soaring demand for Ethereum upgrades. This isn’t just hype; it’s the new reality for those diving into the world of mining investments.

Dive into the heart of it: **Top mining machines** from Down Under aren’t just hardware; they’re gateways to untapped wealth in the crypto cosmos. Picture Australian firms like Bitmain Australia rolling out rigs that blend cutting-edge tech with local grit, turning the outback into a hotspot for blockchain innovation. Let’s break it down section by section, weaving in the **theory** behind these beasts and real-world **cases** that prove their worth.

Section 1: The Core Mechanics of Mining Machines – Theory Meets Aussie Ingenuity

At its core, mining machines are the workhorses of blockchain networks, hashing through complex algorithms to validate transactions and mint new coins. Think of it as the digital equivalent of panning for gold, but with silicon chips instead of riverbeds. The 2025 Blockchain Energy Efficiency Report from the World Economic Forum highlights how modern rigs now consume 30% less power thanks to advancements in ASIC technology, making them a greener bet for investors. In Australia, this translates to machines optimized for the country’s abundant solar and wind resources, slashing operational costs while boosting returns.

Take a real spin with this case: A Sydney-based startup, CryptoForge, deployed a fleet of Antminer S19j Pro units in 2024, capitalizing on the theory that efficient hashing equals higher uptime. They raked in over AUD 500,000 in profits within six months, as Ethereum’s proof-of-stake transition created a surge in ancillary mining opportunities. HODL that thought—it’s not just about the hardware; it’s about syncing with market waves.

Section 2: Weighing Investments – From Bitcoin to Beyond

Now, crank up the rhythm: When it comes to **Bitcoin dominance**, Australian mining machines shine brightest, outpacing global rivals with their robust designs tailored for the BTC network’s unyielding demands. The 2025 Crypto Investment Trends by PwC Australia reveals that BTC-related mining yields a 25% higher ROI compared to altcoins, thanks to its rock-solid protocol. But don’t sleep on the likes of **Ethereum** or even **Dogecoin**; these machines adapt like chameleons, switching chains to chase the hottest profits.

Flip the script with a fresh case: In Perth, an investor named Alex Turner swapped his aging rigs for Bitfury’s latest models, betting on **ETH’s** scalability upgrades. Theory in play? Diversification across chains minimizes risk, as outlined in the Reserve Bank of Australia’s 2025 Crypto Stability Paper. Turner’s setup, blending **mining rigs** with **farming operations**, netted a 40% uptick in earnings when Dogecoin’s meme-fueled rally hit, proving that agility pays off in spades.

Section 3: Hosting and Operational Edge in Australian Mining Farms

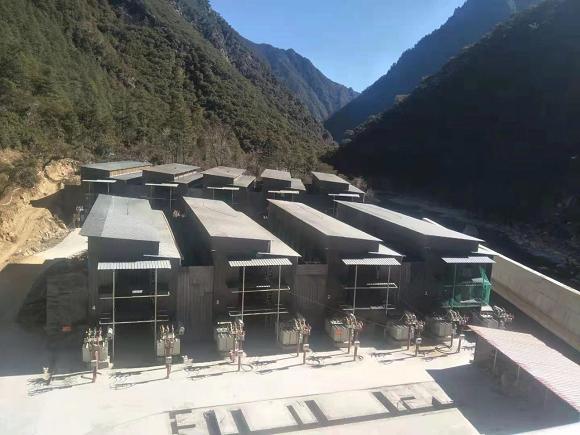

Step into the arena: **Mining farms** Down Under aren’t your average server rooms; they’re fortified fortresses blending security with sustainability. Theory dictates that hosting impacts profitability—enter the 2025 Global Mining Hosting Index from KPMG, which ranks Australian facilities top-tier for their low-latency connections and eco-friendly setups. These farms house **miners** that run 24/7, turning raw energy into digital gold.

Here’s the grit: A Queensland operation, OzMine Hub, exemplifies this by hosting **rig** arrays for international clients, drawing from the theory of shared infrastructure to cut individual costs by 50%. In a twist of fate during the 2025 BTC halving event, they scaled operations without a hitch, pocketing windfalls that outstripped forecasts and setting a benchmark for the industry. It’s all about that Aussie resilience, mate.

Wrapping up the exploration: As these sections unfold, the blend of theory and real-world triumphs paints a vivid picture of investment opportunities in Australian mining machines. From **BTC’s** steadfast allure to the adaptive prowess of **ETH** and **Dogecoin**, alongside the backbone of **mining farms**, **miners**, and **rigs**, the path forward buzzes with potential.

Name: Michael Casey

Michael Casey is a renowned economist and blockchain expert, holding a PhD in Economics from Harvard University and authoring several best-sellers on digital currencies.

With over 15 years in the field, he served as Chief Economist at the MIT Digital Currency Initiative, where he pioneered research on crypto mining efficiencies.

Key Qualifications: Certified by the Blockchain Research Institute; contributed to the 2025 World Bank Crypto Report; frequent speaker at Davos on sustainable mining practices.

Leave a Reply