The journey of mining Bitcoin—a venture both exhilarating and daunting—unfolds against a backdrop of fluctuating market conditions and ever-volatile energy prices. As investors gravitate toward cryptocurrencies, the question looms: can one forecast the rising costs of Bitcoin mining, and how will these shifts influence the market at large? The answer isn’t as straightforward as it may seem, but a multifaceted exploration can illuminate the path ahead.

At its core, Bitcoin mining is the process of validating transactions and adding them to the blockchain, which requires significant computational power. Each mining rig, a specialized computer—an engineer’s marvel—requires copious amounts of electricity. Thus, energy prices become a crucial player in the economics of mining. When the energy costs soar, it can drastically affect the operational costs and, in turn, the profitability of mining methods.

One cannot discuss Bitcoin mining without acknowledging the ever-looming specter of regulation. As countries worldwide grapple with cryptocurrency policies, the mining sector faces new challenges. Regions with stringent electricity costs yet favorable mining regulations may emerge as unlikely havens for miners, while others may find themselves scaling down operations due to rising fees. This dance of regulation impacts energy procurement and operational strategies, leading to a domino effect throughout the industry.

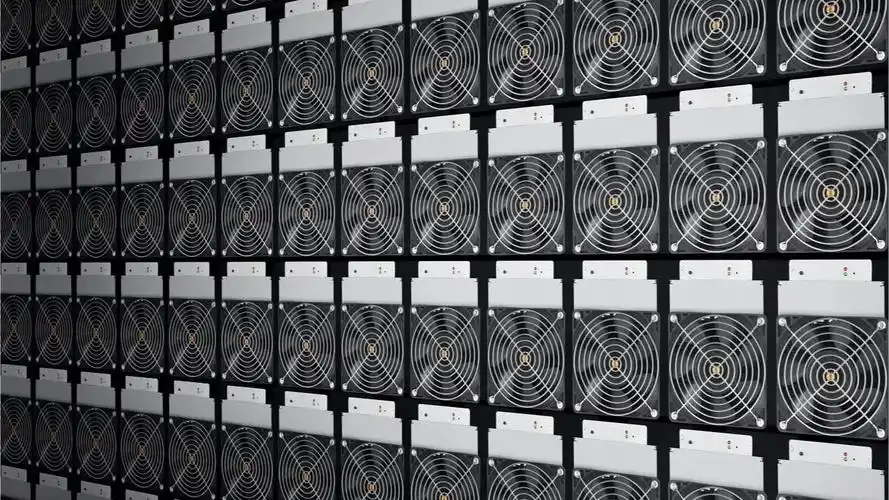

In addition to governmental factors, technological advancements in mining hardware are transforming the landscape. Mining rigs continue to evolve, becoming more energy-efficient with increased hashing power. Firms that prioritize investing in cutting-edge technology stand to gain the most; the ability to mine at lower costs while maximizing potential revenue sets the stage for dependency on not just price, but on innovation.

Cryptocurrency miners have the opportunity to host their machines in specialized mining farms, which can provide not just the right environment featuring optimal cooling and power supply, but also economies of scale that make mining far more profitable. Hosting has emerged as a strategic advantage, allowing individual miners to pool resources and benefit from reduced overhead costs. This collaborative trend indicates a promising future where the community thrives on shared infrastructure.

Bitcoin has seen unprecedented market fluctuations, and the correlation between mining costs and the price of Bitcoin itself is a complex relationship. When Bitcoin prices surge, mining becomes more lucrative, enticing more individuals to enter the space. However, with increased competition, the network’s difficulty adjusts, escalating costs for miners. Conversely, during bearish trends, the profitability of mining can plunge, driving many less efficient miners out of business. This cyclical nature creates a fragile ecosystem teetering on the brink of profitability and loss.

Exploring further into altcoins, miners looking to diversify their portfolios may consider Ethereum or Dogecoin. Each currency presents unique mining dynamics and varying energy expenditures. Ethereum has been making strides toward proof-of-stake, potentially reshaping miners’ strategies and thus impacting their profitability. Dogecoin, with its enthusiastic community, generally requires less hardware capability – making it an attractive alternative for novice miners.

As new technologies and trends develop, miners must remain adaptable. This encompasses not just the machines they use but their approaches to energy procurement, market strategies, and regulatory adherence. Understanding the nuances of exchanges, market sentiments, and the relationship between supply and demand can arm miners with knowledge, allowing them to thrive in unpredictable environments.

The horizon for Bitcoin mining is undoubtedly multifaceted, riddled with challenges yet brimming with opportunity. As miners navigate through cost forecasts and fluctuating landscapes, those who embrace innovation and community collaboration will most certainly find their footing. The delicate balance between energy prices and market conditions may ultimately shape the future of this burgeoning industry, inviting new artisans seeking to craft their fortune from the codes and blocks of the digital age.

Leave a Reply to Drew Cancel reply